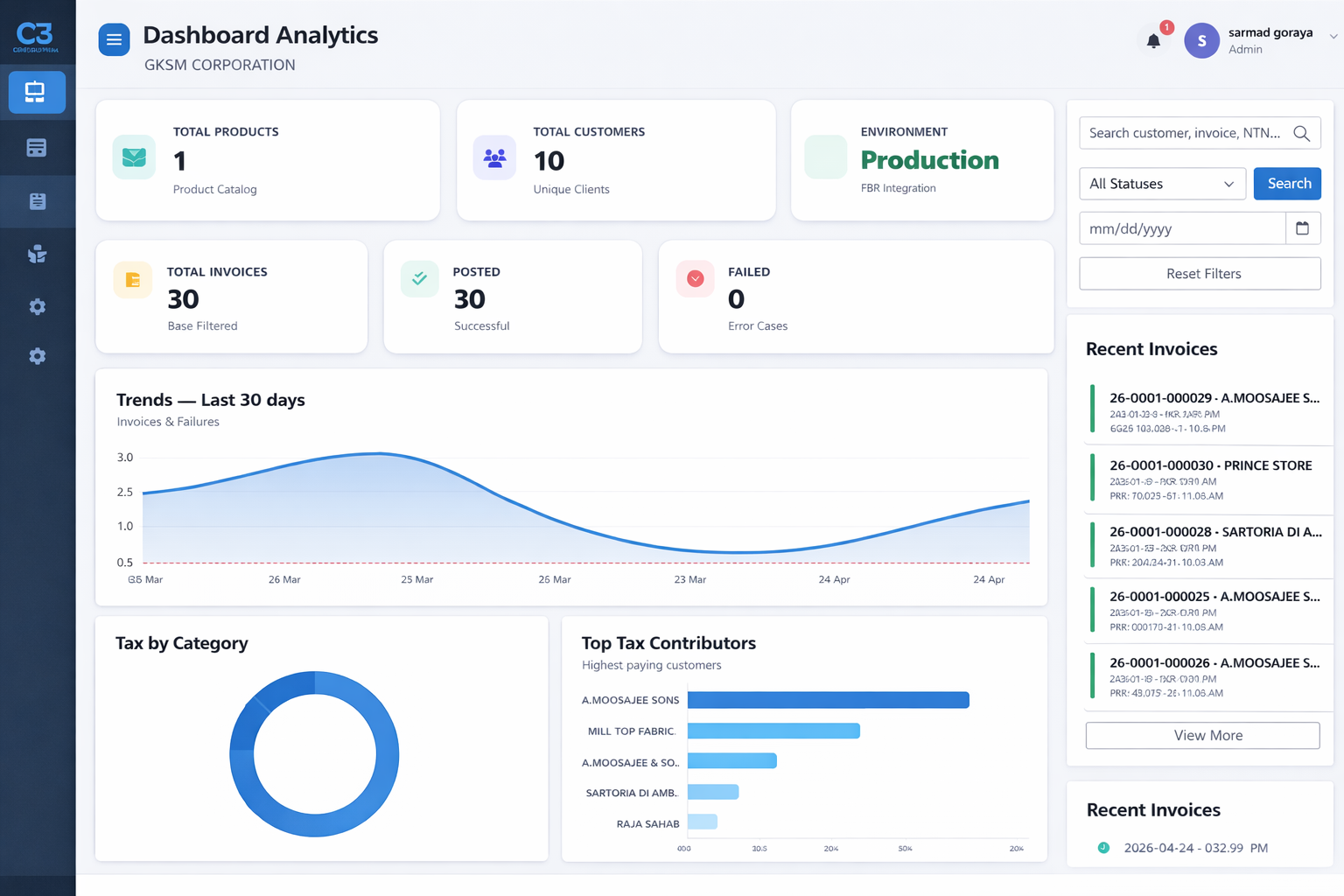

Real-Time Business Intelligence

Monitor your invoicing performance, tax obligations, and compliance status through comprehensive analytics and reporting tools.

- Live invoice tracking and status monitoring

- Monthly sales tax summaries and projections

- Customer payment history and credit analysis

- FBR submission logs with verification receipts

- Exportable reports for accounting and audits